When I moved to the US I was faced with a problem.

How do I transfer my money from my UK bank accounts to my newly opened US account?

Banks charge excessive fees for transfers and when transferring large sums of money, there was no way I was going to pay more than I needed to. My current UK bank (Halifax) charges £9.50 for any international transfer, plus a £12 US “correspondent bank fee”. There’s also a 3.20% markup between the exchange rate they give me and the actual wholesale exchange rate!

So instead, I decided to use Transferwise to send money between my two accounts. I had used it in the past to pay for a hostel room in Lanzarote where the hostel only accepted wire transfers to a European account. It was quick and easy and a great success. Since then, I’ve been using Transferwise for all my international transfers.

How does Transferwise work?

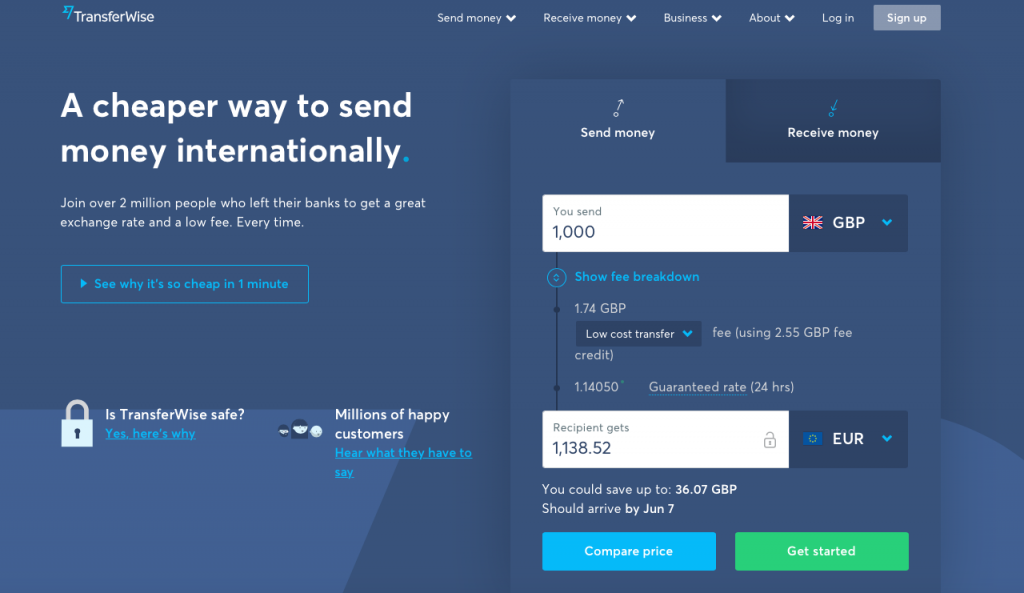

TransferWise is basically a way to transfer money abroad without the crazy bank fees. Instead of paying the ridiculous markups and fees charged by the banks, with Transferwise you always get the mid-market exchange rate, which is the fairest exchange rate.

So how is it cheaper?

Well, Transferwise basically has bank accounts in different countries.

You send money to Transferwise’s bank account in your country.

Then tell them who you’re sending it to.

Transferwise calculates the conversion.

Transferwise then sends the amount to your recipient from their bank account in the recipient’s country.

The money never actually crosses any borders, which means they can charge the smallest possible fee to convert your money.

Get it?

Whenever you make a transfer you’re told exactly what you’re paying, so there are no surprises afterwards. Fees are always taken from the amount you send, so the recipient doesn’t pay for the transfer – you do.

What does transfer wise charge?

Transferwise charges a percentage fee, which is a percentage of the amount you’re sending to cover the cost of the currency conversion. They also charge a flat rate transaction fee on certain currencies.

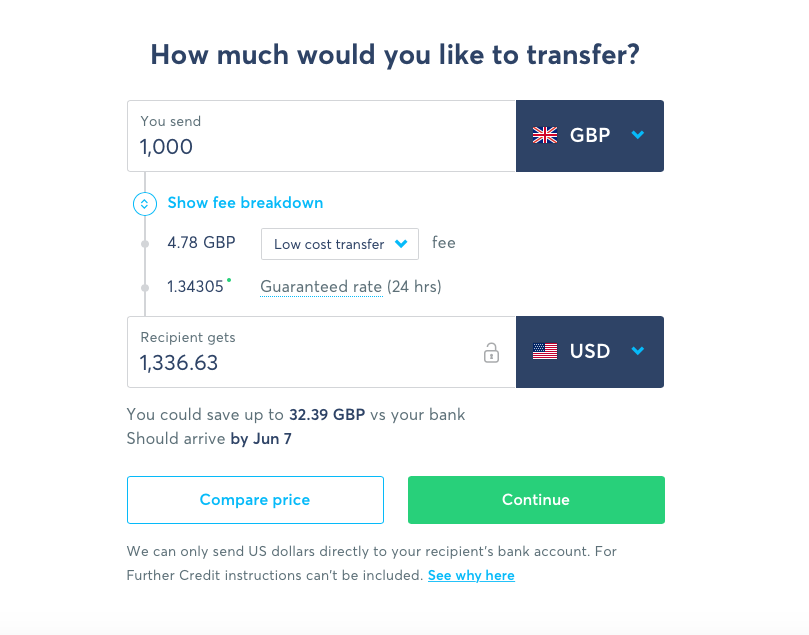

For GBP to USD:

0.4% + £ 0.80 flat transaction fee

As an example, if wish to transfer money today, £1000 would be converted to $1,336.63 at the fairest exchange rate and I’d be charged a Transferwise fee of just £4.78 GBP, which is much cheaper than my bank!

My experience with transferring money

To send money I just have to choose the amount I’d like to send and then select the currency I’d like to convert it to. Transferwise shows how much the recipient will get and the exact fee I’ll be charged.

On the next page I can choose who I’d like to send it to – Myself, someone else or a business/charity. I just need to enter some basic info, such as their bank account details, email and address.

When it comes to sending there are a few ways you can pay. Bank transfer is usually the cheapest and this involves sending the money to Transferwise’s bank account with a specific reference number so they know it’s you. As soon as they receive your money they’ll initiate the transfer.

Alternatively you can pay by debit or credit card, which is how I usually pay just for the convenience. The fee is slightly higher by paying this way but I have never found it to be much more than a £ or two.

How long does it take?

If I initiate a transfer on a weekday, usually it arrives next working day to my US bank account. If it’s a weekend it can take longer because Transferwise can only handle your money during normal bank hours.

My verdict

I love Transferwise and I use it a lot to Transfer money from my UK accounts to my US accounts. Why pay £25+ when I could pay just £4-£5? It’s quick, it’s easy and I can use the mobile app on the go. Typically transfers take 1 or 2 working days, so I never have to wait too long. Plus I always get notifications and emails when my money has been sent.

Get your first transfer free

To get your first Transferwise transfer free, use my invite link: https://transferwise.com/i/victoriab152

By following my link you’ll get your first transfer free, up to £500 (or an equivalent value in whatever country you’re in).